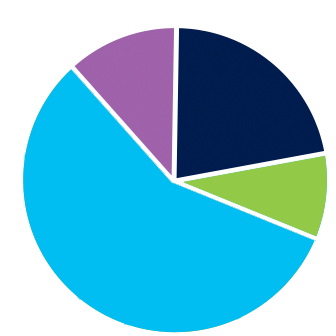

Domestic Equity

International Equity

Cash Equivalents

Objectives

The Conservative Investment Option seeks to provide current income and some growth by investing 30% of its assets in diversified investments of domestic and international equity funds (stocks), 40% in fixed income funds and 15% in inflation-protected securities (bonds), and 15% in money market funds (cash equivalents).

This Investment Option may be appropriate for those who will be investing for five years or less, or if your primary investment objective is low risk with a minimal potential risk for loss.

| Underlying Estimated Fund Expenses1: | 0.05% |

| Program Management Fee: | 0.40% |

| TOTAL: | 0.45% |

1As of January 1, 2019

.png)